Passive Funds

Perception very rarely equals reality in the investment industry. Be it the perception that investors can time markets or the perception that headline index levels show that markets have not risen for 10 years or more since the dotcom bubble in 2000.

Perception very rarely equals reality in the investment industry. Be it the perception that investors can time markets or the perception that headline index levels show that markets have not risen for 10 years or more since the dotcom bubble in 2000.

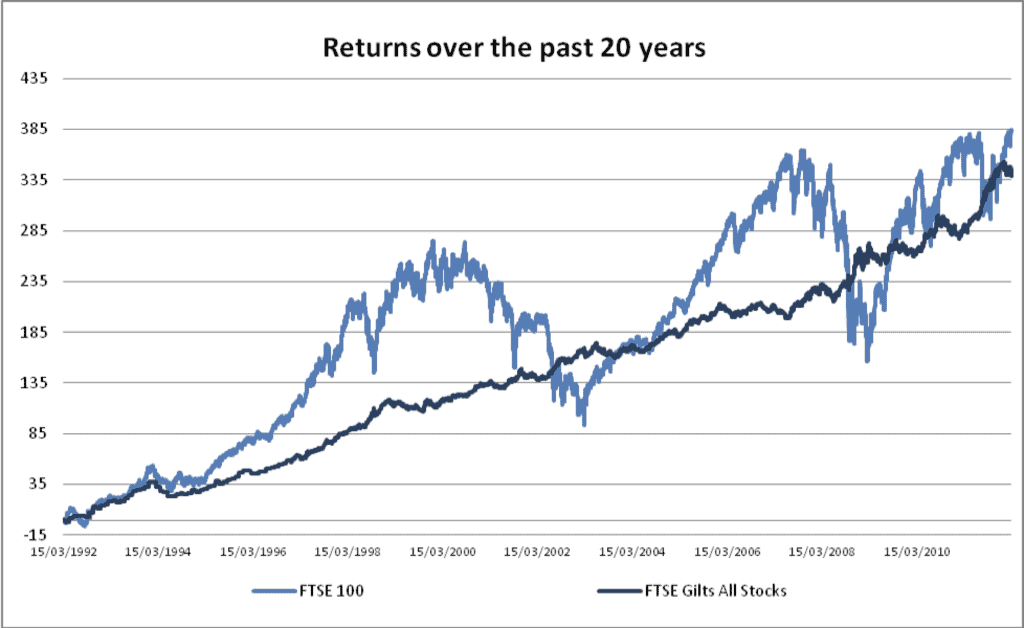

Well, this week we looked again at the perceived ‘poor’ equity market returns of the recent past and the perceived stellar returns from fixed interest. This must be reality as the UK government bond market has enjoyed one of its most spectacular bull runs in over 100 years returning over 300% over the past 20 years.

Perception has been (in our eyes as well as our clients) that equity market returns in the UK have been relatively poor over the period in question. Well not in reality! The chart below shows a little talked about fact: the total returns from equities and bonds in the UK have been equally excellent over the past two decades. Equity returns are actually at a 20 year high.

Investors would do well to remember that their experience of markets is exactly that, their experience.

Opinions constitute our judgement as of this date and are subject to change without warning.

Latest articles

Looking back at the Greek Crisis

Investors can be forgiven for feeling rather nervous of recent economic and political events. Clients have become concerned over the past months as the FTSE…

Demographics Drive Returns

Demographics are deemed to be a driver of investment returns. The argument goes that the bigger the proportion of the population that is of a working age, th…

2nd Part of Passives

Continuing on from our last Thought about index trackers and their complexities, this week we focus on the more complex vehicles available to UK investors.

Forecasting

Investors spend a lot of time focussing on the investments that have lost money in their portfolio. This is a common trait as no-one likes to lose money and…