Demographics Drive Returns

Demographics are deemed to be a driver of investment returns. The argument goes that the bigger the proportion of the population that is of a working age, the greater the economic value creation and the lower the drain on the public purse.

Demographics are deemed to be a driver of investment returns. The argument goes that the bigger the proportion of the population that is of a working age, the greater the economic value creation and the lower the drain on the public purse. These working people, then begin to save, providing a marginal buyer to equity markets as they have long time horizons and return requirements that outstrip cash deposit rates.

In the developed world, the latest generation of these ‘wealth creators’ has been dubbed the Baby Boomers.

Now as global investors, we believe that the sheer size of the populations in China and India will drive economic growth for many years to come. The middle classes here will increase their spending as their income rise and this will provide the world with another pillar to growth. Size however, isn’t the only important factor…

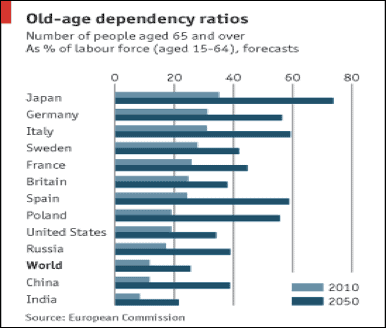

The recent sovereign debt issues in the US and Eurozone have illustrated quite clearly that governments need to be careful when overpromising future generations. In Italy, it is forecast that there will be more than one adult aged over 65 for every two people of working age by 2050. This is an increase from one for every four of working age! The story is similar in Germany, worse in Japan, but remarkably, not such as marked change in the UK or the US. The chart below shows the old-age dependency ratios published by the European Commission on a regular basis and includes China and India.

The interesting point that is not really acknowledged by most global investors is that the Chinese population is aging dramatically and that over the next 40 years, the dependency ratio will increase from 15 (15 retirees for every 100 of working age) to 39. This will impact policy and put pressure on the Chinese government to manage this position carefully as increasing wealth and expectations of your population cannot be reversed as they get older.

India on the other hand, has the best demographic profile of all of the countries shown above, an interesting fact that not many people know.

Opinions consistute our judgement as of this date and are subject to change without warning.

Latest articles

Looking back at the Greek Crisis

Investors can be forgiven for feeling rather nervous of recent economic and political events. Clients have become concerned over the past months as the FTSE…

Passive Funds

Perception very rarely equals reality in the investment industry. Be it the perception that investors can time markets or the perception that headline index…

2nd Part of Passives

Continuing on from our last Thought about index trackers and their complexities, this week we focus on the more complex vehicles available to UK investors.

Forecasting

Investors spend a lot of time focussing on the investments that have lost money in their portfolio. This is a common trait as no-one likes to lose money and…