Forecasting

Investors spend a lot of time focussing on the investments that have lost money in their portfolio. This is a common trait as no-one likes to lose money and is referred to by academics as ‘loss aversion’.

Investors spend a lot of time focussing on the investments that have lost money in their portfolio. This is a common trait as no-one likes to lose money and is referred to by academics as ‘loss aversion’.

Although we do not like losing money on any investment at Tacit, investment management is a profession in which risk of loss can never be truly eliminated. The important thing is to own investments that have an economic value rather than a manufactured profile based on particular scenarios playing out over a predefined time frame. The assets one owns will go up and down over the short term, but the underlying economic value is what will dictate their trajectory over a meaningful time horizon.

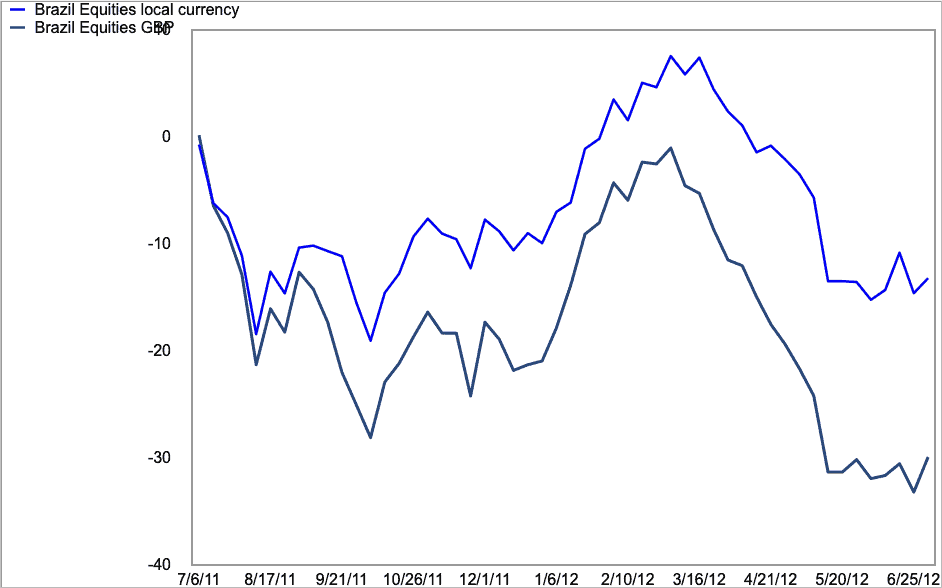

Take Brazilian equities for example. Over the past twelve months, UK investors in Brazilian equities have suffered a near 30% loss. This is difficult to stomach even for the most risk taking investor and with 20-20 hindsight this investment would not have been made. The key now however is to understand why the loss has occurred and whether the underlying value has been eroded for the future.

Brazil Equities over 1 year

The 30% loss was actually made up of two factors: the loss in equity values but more interestingly the depreciation of the Brazilian Real. The charts below illustrate that the currency depreciation has been that major driver of losses for UK investors over this period.

Government intervention has been particularly strong on the exchange rate on the grounds that a weaker exchange rate can be a driver of growth. After imposing a myriad of capital controls through taxation on foreign capital flows, local derivatives and corporate short-term external debt issuance, the Brazilian government has been able to engineer some sustainable depreciation of the currency after a period of strong appreciation post 2008.

The longer term fundamentals of the economy remain strong with domestic consumption growing at 15-20% per annum. Market valuations are cheap: as an example, Petrobras, the oil company, currently trades on a multiple of 7 times, whereas BG Group of the UK trades on 16 times prospective earnings! The broader Bovespa index trades on 8 times.

It is our firm belief that a global investment outlook will provide superior returns over the longer term and that economic value will win through in the end.

6th July 2012

Opinions constitute our judgement as of this date and are subject to change without warning.

Publish date

Categories

News Industry Thought pieces

Latest articles

Looking back at the Greek Crisis

Investors can be forgiven for feeling rather nervous of recent economic and political events. Clients have become concerned over the past months as the FTSE…

Demographics Drive Returns

Demographics are deemed to be a driver of investment returns. The argument goes that the bigger the proportion of the population that is of a working age, th…

Passive Funds

Perception very rarely equals reality in the investment industry. Be it the perception that investors can time markets or the perception that headline index…

2nd Part of Passives

Continuing on from our last Thought about index trackers and their complexities, this week we focus on the more complex vehicles available to UK investors.